Avoid Stupid Decisions—Set It and Forget It

As you approach retirement, the pressure to create a strong portfolio that will support you during your golden years can be overwhelming.

Protect Your Money with 5 Simple Investments

Individual investors often have no clue what they’re doing.

They pour into the markets and buy a bunch of garbage. I don’t support any of this: people gambling with money they can’t afford to lose.

That’s why I’m going to show you how to start investing like an adult.

First, investing has prerequisites. Before you put one penny in the market, you need an emergency fund with at least $10,000 or enough to cover six months’ worth of living expenses, whichever is greater.

You also need to rein in your debt. Pay off your credit cards and car loans before investing. And take a chunk out of any student loan debt and your mortgage if you have one.

But don’t put off investing indefinitely. If you wait 30 years to pay off your mortgage and start investing, it’s going to be too late.

Invest as Much as You Can

Once you’ve established your emergency fund and tackled your debts, you’re ready to invest. And you want to invest as much as you can. I mean it: Invest as much as humanly possible.

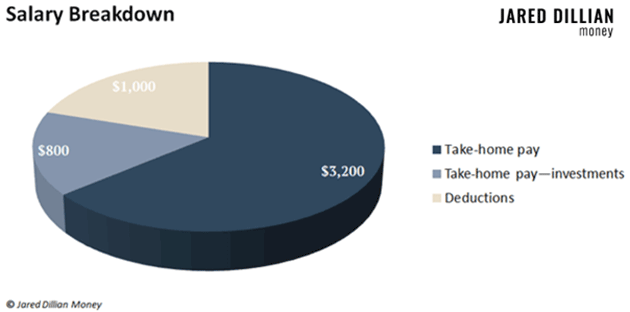

If you’re in your 20s, you want to invest at least 20% of your take-home pay. I’ll walk you through an example…

Say your salary is $5,000 per month. Right off the top, about 20% comes out in taxes, Social Security, and Medicare contributions—all the deductions that come out before you see your paycheck.

Whatever is left is your take-home pay. In this example, we’ll say it’s $4,000. So, 20% of that is $800 a month.

This is the minimum you want to invest in your 20s... 20% of your take-home pay.

If you can’t make that happen, look closely at your income and spending. Can you really afford the house or apartment you live in? Are you spending too much on your car or vacations?

For that matter, could you get a new job and make more money?

Only you can answer these questions. But my guess is you could set aside 20% of your take-home pay. You might need to make some changes at first, but over time, this will become a habit.

What if you really can’t set aside 20%?

Do not let perfect be the enemy of good. If you start investing 10% or 15% of your take-home pay when you’re 22, you are light-years ahead of the guy who’s investing nothing, even if he’s earning more money.

The most important thing is to start investing as early as you can. Then work on controlling your expenses so you reach that 20% goal as quickly as possible.

A Late Start Is Better than No Start

What if you’re in your 40s or 50s and just starting to invest?

By now, you’re likely earning more, but your expenses have gone up as well. You might have a family, kids, a house—all expensive.

Even so, your goal is to invest half of your take-home pay.

Why so much? First, you’re playing catch-up. Second, your investments will compound over time. That means the profits you earn will start earning profits.

The other reason to invest as much as possible is your investments may fall in value from time to time. You will need time to recover. The key is to keep investing and building wealth. If you do it right, you’ll be free to spend more in the years to come.

The Big Deal with Compound Interest

I can’t overstate the importance of investing as early and as much as possible. It all goes back to a magical little thing called compound interest.

The simplest way to think of compound interest is “interest on interest.” Instead of just earning interest on your initial or principal investment, the interest you earn gets added back into the principal… and you earn interest on it as well.

Compound interest makes a massive difference in your overall returns…

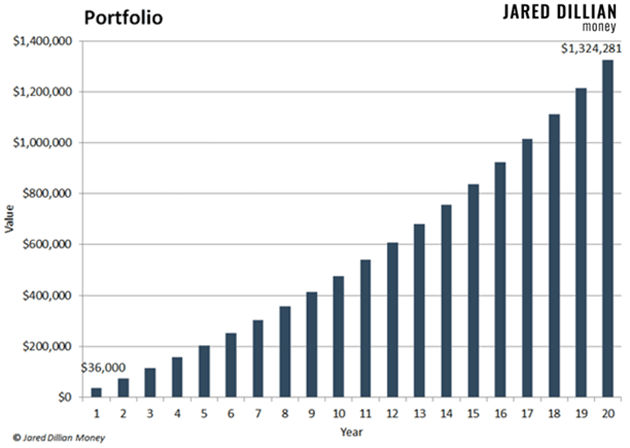

Say you’re 45 years old, and your take-home pay is $6,000 a month. You’re just starting out, so you wrangle in your expenses and invest 50% of your take-home pay. That’s $3,000 a month, or $36,000 a year.

Over the next 20 years, your investments return 6% on average. Don’t touch those returns! Leave them in your investment account, and they will start making money for you, too. By the time you’re 65 years old, there’s $1.32 million in your account.

Not bad, especially considering you only started to invest in your 40s.

Where to Invest

Everybody loves stocks. Everybody wants to buy stocks.

But here’s the thing... you should NOT put all your investments in the stock market.

Instead, you want to hold some stocks, some bonds, some cash, some gold, and some real estate. This is the best way to steadily grow your wealth over time and cut your risk of losing money to the bare minimum.

Of course, there’s a lot more to it than “some of this, some of that.” That’s where The Awesome Portfolio comes into play.

Inside, you’ll find:

✅ All the ticker symbols you need to jumpstart your investing journey

✅ The exact amount to put in each investment

✅ How to tweak your portfolio as market conditions change

It pains me to see countless investors buy garbage stocks, risking hard-earned dollars they can’t afford to lose. But you can avoid all that and start safely investing in your future.

Claim your copy of The Awesome Portfolio today to better protect your money from the whims of the market.

Jared Dillian

|

Simple Ways to Boost Your Credit Score

Unless you have a perfect credit score, you probably want to improve it.

Do Your Own Taxes While Your Financial Life Is Simple

Master the basics and develop your tax literacy.‹ First < 12 13 14 15 16 > Last ›